Preparing for Residential Care in Retirement

Many people associate estate planning with death and nothing else. However, proper estate planning includes far more than just writing a will. A well-written estate

Many people associate estate planning with death and nothing else. However, proper estate planning includes far more than just writing a will. A well-written estate

When you file for divorce, you may assume it’s obvious that you no longer want to be legally and financially connected to your spouse. If

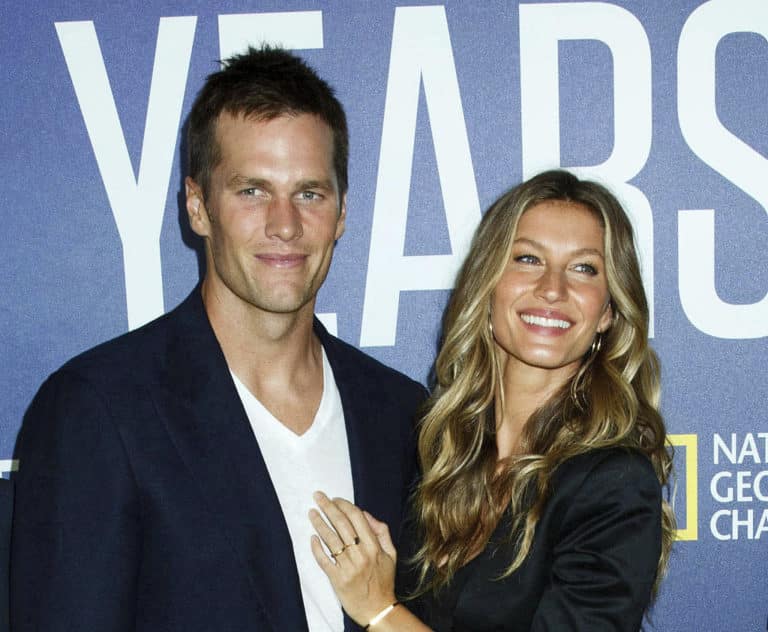

In a surprise announcement, legendary quarterback Tom Brady and internationally famous supermodel Gisele Bündchen declared their divorce was final last month. While it was not

The estate tax is a tax imposed on a person’s assets after death. California does not have an estate tax, but there is still a

If the time is right for you to create your estate plan, there are certain elements to consider. Here are four common mistakes you can

An estate plan can help you plan for the future. With a well-written strategy, you can maintain control of your assets despite incapacitation or other

When you and your spouse decide to split up, you may not have much insight into the process. A commonly divisive issue that comes along

Understanding the importance of choosing a respectful and thoughtful executor is key for you and any beneficiaries in your life. After you die, you want

When you begin the estate planning process in California, you will appoint a personal representative to act as the administrator of your affairs upon your

When sibling rivalries grow wildly out of control, it can result in major problems for everyone involved. This is especially true when it comes to